MINNEAPOLIS – The Minneapolis school district announced some startling financial news in May 2016.

District officials said they would be facing an “unexpected budget deficit of nearly $17 million” for the current school year, according to a report from MPnews.org.

District officials said they would be facing an “unexpected budget deficit of nearly $17 million” for the current school year, according to a report from MPnews.org.

MORE NEWS: Know These Before Moving From Cyprus To The UK

School officials said they “failed to account for retirement plan contributions and teacher salary increases, and they underestimated some other expenses in the district budget,” the news report said.

School board chair Jenny Arneson said the Minneapolis district would take a much closer look at its budgeting procedures.

“Just as it’s important to budget down to the penny in your household budget, it’s not really different in a large institution,” Arneson was quoted as saying in the news report. “You need to be able to balance down to the penny and know exactly where every dollar is going. And that is our philosophy.”

Perhaps school officials should take a close look at the district payroll, and all the extra costs involved with employee benefit payments.

A good example is the amount of compensation designated for the superintendent. The job was filled by two interim superintendents during fiscal year 2015-16, before the school board hired a permanent superintendent in March.

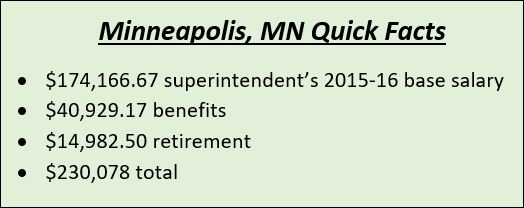

In its response to an open records request, the Minneapolis district reported that the “superintendent salary” in 2015-16 was $174,166.67.

MORE NEWS: How to prepare for face-to-face classes

But there was a lot more compensation than that.

But there was a lot more compensation than that.

The three superintendents were paid a combined $40,929.17 in various types of benefits in 2015-16.

The district also made a $14,982.50 in retirement benefits on behalf of the superintendents. “This includes amounts paid to the Public Employee Retirement Account (PERA) and a matching contribution to the Superintendent’s 403B account,” the district wrote.

So the people holding the superintendent position in 2015-16 were actually compensated at least $230,078.34 – $55,911 more than the base salary.

That’s just one example of the type of extra spending that occurs up and down the payroll, with retirement contributions and contractual benefits significantly increasing labor costs for the district and taxpayers.

We also sought salary, benefit and retirement figures for Minneapolis teachers, but the school district never provided that information.

That’s not surprising, we suppose, considering all the payroll and budgeting confusion that seems to be going on in the school district.

Join the Discussion

Comments are currently closed.