JOLIET, Ill. – A recent national study determined that Illinois has the highest property taxes in the nation, according to the Chicago Tribune.

“Nationally, the median property tax rate is 1.31 percent,” the newspaper reported. “That means that a home valued at $200,000 will, on average, pay annual total property taxes of $2,620. In Illinois, that homeowner would pay $5,340.”

“Nationally, the median property tax rate is 1.31 percent,” the newspaper reported. “That means that a home valued at $200,000 will, on average, pay annual total property taxes of $2,620. In Illinois, that homeowner would pay $5,340.”

MORE NEWS: Know These Before Moving From Cyprus To The UK

Just because someone lives in a home valued at $200,000 (which is pretty common with inflated property values these days) does not mean they are wealthy by any means. Paying more than $5,000 per year in property taxes is a serious hit.

But in 2015, when Illinois state lawmakers were considering a bill that would have frozen property taxes and provided some temporary relief, officials from the Joliet Township High School District 204 expressed opposition.

“Although it sounds really good, it will have a huge impact on our budget,” district Superintendent Cheryl McCarthy was quoted as saying by TheHeraldNews.com.

There’s no doubt that the school district would be hurt by any sort of decrease in revenue, because it spends a boatload of money on labor costs, particularly employee benefits.

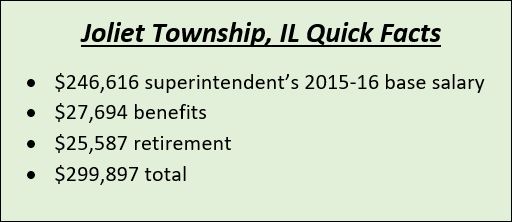

Take the superintendent’s compensation package, for instance.

In 2015-16, McCarthy made $246,616 in base salary, $27,694 in health insurance and other benefits, and the school district made a $25,587 retirement contribution on her behalf.

In 2015-16, McCarthy made $246,616 in base salary, $27,694 in health insurance and other benefits, and the school district made a $25,587 retirement contribution on her behalf.

MORE NEWS: How to prepare for face-to-face classes

That brought her one-year compensation total to at least $299,897 – $53,731 more than her base salary.

The 352 Joliet Township teachers were paid a combined $25,996,303 in base salary, for an average of $73,853 per teacher. They were also paid a combined $3,128,855 in benefits, for an average of $8,888 per teacher.

That brought the average yearly compensation for Joliet teachers to at least $82,741.

That’s just an average. A total of 33 Joliet teachers were paid base salaries of at least $100,000 in 2015-16. Another 21 had base salaries of at least $90,000.

Teacher John-David Wieitlispach made a base salary of $129,652 and received benefits worth $23,404. That adds up to $153,056.

Teacher Jeanne Uffmann made a base salary of $133,632 and received benefits worth $20,974. That adds up to $154,606.

No wonder Joliet Township administrators weren’t keen on the idea of property tax relief. They have a very big payroll, and can’t afford to lose a dime in revenue.

Join the Discussion

Comments are currently closed.